|

|

Published March 2025*

| Location: |

Area 5300 |

| Price Range: |

$800,000 - No Limit |

| SQFT Range: |

2000 - No Limit |

| Property Types: |

Residential - Single Family Homes and Condo/Coop/Villa/Twnhse Combined - All Properties - All Properties - All Properties |

| Bedrooms: |

0 - No Limit |

| Full Baths: |

0 - No Limit |

| Half Baths: |

0 - No Limit |

| Year Built: |

0 - No Limit |

|

Prepared for you by: Laura Cole & Tana Gaskill Prepared for you by: Laura Cole & Tana Gaskill

|

|

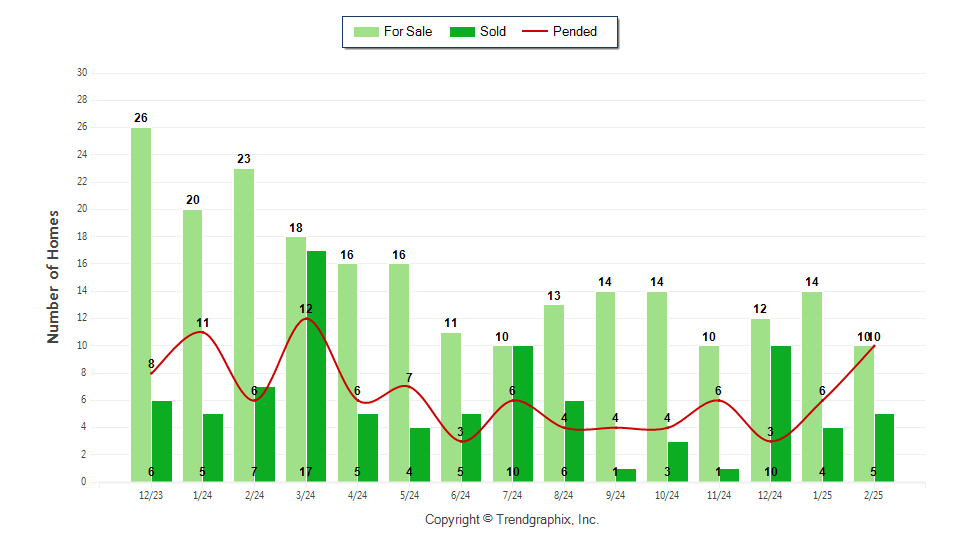

Number of Homes For Sale vs. Sold vs. Pended (Dec. 2023 - Feb. 2025)

|

| Curnt vs. Prev Month | Curnt vs. Same Month 1 Yr Ago | Curnt vs. Same Qtr 1 Yr Ago | | Feb. 25 | Jan. 25 | % Change | Feb. 25 | Feb. 24 | % Change | Dec. 24 to Feb. 25 | Dec. 23 to Feb. 24 | % Change | | For Sale | 10 | 14 | -28.6%  | 10 | 23 | -56.5%  | 10 | 23 | -56.5%  | | Sold | 5 | 4 | 25%  | 5 | 7 | -28.6%  | 19 | 18 | 5.6%  | | Pended | 10 | 6 | 66.7%  | 10 | 6 | 66.7%  | 19 | 25 | -24%  |

| TODAY’S STATS | | Current vs. Prev MTD | Current vs. Same MTD 1 Yr Ago | Current vs. Prev YTD | | 3/1/25 - 3/13/25 | 2/1/25 - 2/13/25 | % Change | 3/1/25 - 3/13/25 | 3/1/24 - 3/13/24 | % Change | 1/1/25 - 3/13/25 | 1/1/24 - 3/13/24 | % Change | | For Sale | 14 | 13 | 7.7%  | 14 | 18 | -22.2%  | 14 | 18 | -22.2%  | | Sold | 3 | 1 | 200%  | 3 | 3 | 0% | 12 | 15 | -20%  | | Pended | 2 | 4 | -50%  | 2 | 8 | -75%  | 18 | 25 | -28%  |

February 2025 was a Seller's market**

Home For Sale in February 2025 was 10 units. It was down 28.6% compared to last month and down 56.5% compared to last year.

Home Closed in February 2025 was 5 units. It was up 25% compared to last month and down 28.6% compared to last year.

Home Placed under Contract in February 2025 was 10 units. It was up 66.7% compared to last month and up 66.7% compared to last year.

**Buyer's market: more than 6 months of inventory based on closed sales. Seller's market: less than 3 months of inventory based on closed sales. Neutral market: 3 - 6 months of inventory based on closed sales.

|

|

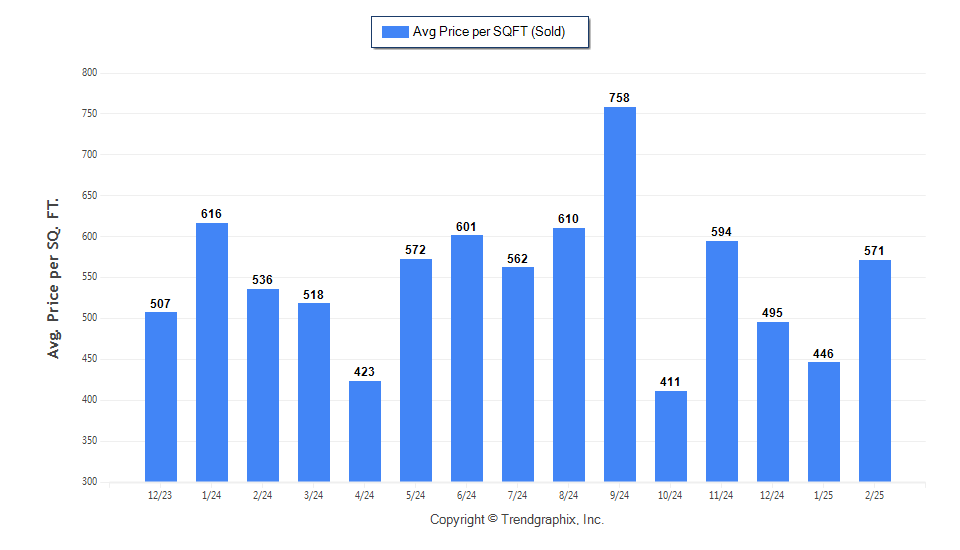

Average Price per SQFT (Sold) (Dec. 2023 - Feb. 2025)

|

| Curnt vs. Prev Month | Curnt vs. Same Month 1 Yr Ago | Curnt vs. Same Qtr 1 Yr Ago | | Feb. 25 | Jan. 25 | % Change | Feb. 25 | Feb. 24 | % Change | Dec. 24 to Feb. 25 | Dec. 23 to Feb. 24 | % Change | | Avg. Sq. Ft. Price (Sold) | 571 | 446 | 28%  | 571 | 536 | 6.5%  | 505 | 549 | -8%  |

| TODAY’S STATS | | Current vs. Prev MTD | Current vs. Same MTD 1 Yr Ago | Current vs. Prev YTD | | 3/1/25 - 3/13/25 | 2/1/25 - 2/13/25 | % Change | 3/1/25 - 3/13/25 | 3/1/24 - 3/13/24 | % Change | 1/1/25 - 3/13/25 | 1/1/24 - 3/13/24 | % Change | | Avg. Sq. Ft. Price (Sold) | 727 | 739 | -1.6%  | 727 | 431 | 68.7%  | 561 | 551 | 1.8%  |

February 2025 Average Sold Price per Square Footage was Neutral**

Average Sold Price per Square Footage in February 2025 was $571. It was up 28% compared to last month and up 6.5% compared to last year.

**Based on 6 month trend - Appreciating/Depreciating/Neutral.

|

|

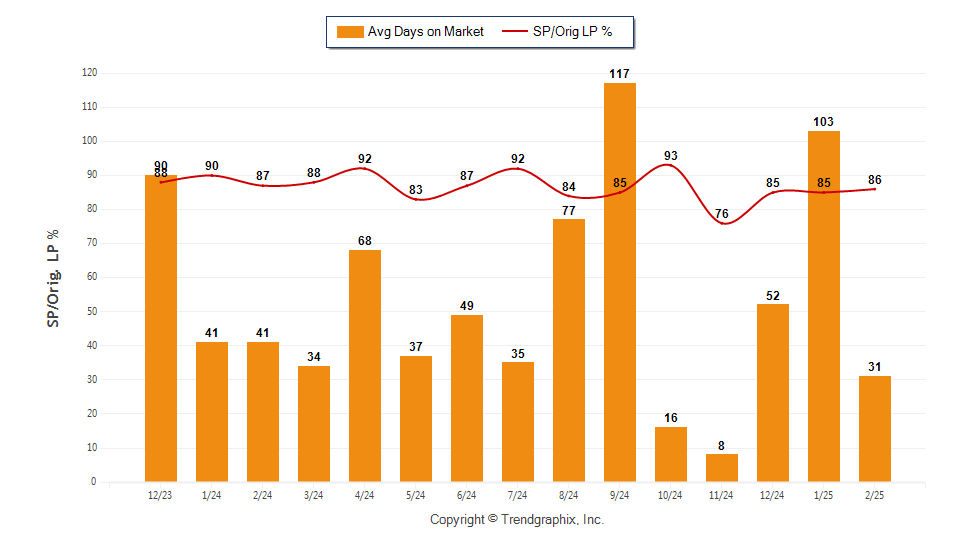

Avg Days On Market & SP/Orig LP % (Dec. 2023 - Feb. 2025)

|

| Curnt vs. Prev Month | Curnt vs. Same Month 1 Yr Ago | Curnt vs. Same Qtr 1 Yr Ago | | Feb. 25 | Jan. 25 | % Change | Feb. 25 | Feb. 24 | % Change | Dec. 24 to Feb. 25 | Dec. 23 to Feb. 24 | % Change | | Avg Days on Market | 31 | 103 | -69.9%  | 31 | 41 | -24.4%  | 57 | 57 | 0% | | Sold/Orig LP Diff. % | 86 | 85 | 1.2%  | 86 | 87 | -1.1%  | 85 | 88 | -3.4%  |

| TODAY’S STATS | | Current vs. Prev MTD | Current vs. Same MTD 1 Yr Ago | Current vs. Prev YTD | | 3/1/25 - 3/13/25 | 2/1/25 - 2/13/25 | % Change | 3/1/25 - 3/13/25 | 3/1/24 - 3/13/24 | % Change | 1/1/25 - 3/13/25 | 1/1/24 - 3/13/24 | % Change | | Avg Days on Market | 35 | 35 | 0% | 35 | 27 | 29.6%  | 56 | 38 | 47.4%  | | Sold/Orig LP Diff. % | 91 | 89 | 2.2%  | 91 | 91 | 0% | 87 | 89 | -2.2%  |

February 2025 Average Days on Market trend Remains Steady**

Average Days on Market in February 2025 was 31. It was down 69.9% compared to last month and down 24.4% compared to last year.

February 2025 Sold/Original List Price Ratio Remains Steady**

Sold/Original List Price % in February 2025 was 86%. It was up 1.2% compared to last month and down 1.1% compared to last year.

**Based on 6 month trend - Rising/Falling/Remains Steady.

|

|

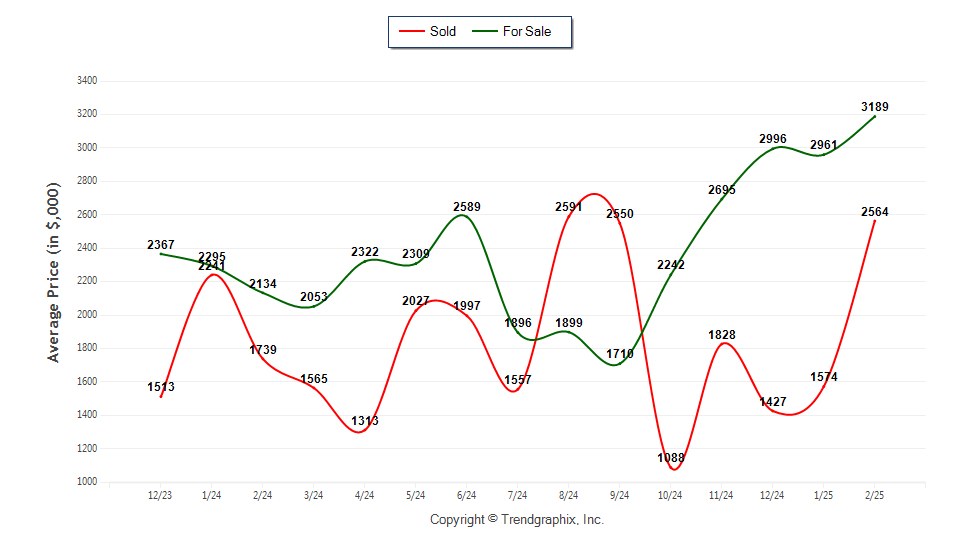

Average Price of For Sale and Sold (Dec. 2023 - Feb. 2025)

|

| Curnt vs. Prev Month | Curnt vs. Same Month 1 Yr Ago | Curnt vs. Same Qtr 1 Yr Ago | | Feb. 25 | Jan. 25 | % Change | Feb. 25 | Feb. 24 | % Change | Dec. 24 to Feb. 25 | Dec. 23 to Feb. 24 | % Change | | Avg. Active Price | 3,189 | 2,961 | 7.7%  | 3,189 | 2,134 | 49.4%  | 3,036 | 2,268 | 33.9%  | | Avg. Sold Price | 2,564 | 1,574 | 62.9%  | 2,564 | 1,739 | 47.4%  | 1,757 | 1,803 | -2.6%  |

| TODAY’S STATS | | Current vs. Prev MTD | Current vs. Same MTD 1 Yr Ago | Current vs. Prev YTD | | 3/1/25 - 3/13/25 | 2/1/25 - 2/13/25 | % Change | 3/1/25 - 3/13/25 | 3/1/24 - 3/13/24 | % Change | 1/1/25 - 3/13/25 | 1/1/24 - 3/13/24 | % Change | | Avg. Active Price | 2,768 | 2,796 | -1%  | 2,768 | 2,053 | 34.8%  | 2,768 | 2,053 | 34.8%  | | Avg. Sold Price | 2,049 | 5,605 | -63.4%  | 2,049 | 1,030 | 98.9%  | 2,105 | 1,765 | 19.3%  |

February 2025 Average For Sale Price was Appreciating**

Average For Sale Price (in thousand) in February 2025 was $3189. It was up 7.7% compared to last month and up 49.4% compared to last year.

February 2025 Average Sold Price was Appreciating**

Average Sold Price (in thousand) in February 2025 was $2564. It was up 62.9% compared to last month and up 47.4% compared to last year.

**Based on 6 month trend - Appreciating/Depreciating/Neutral.

|

|

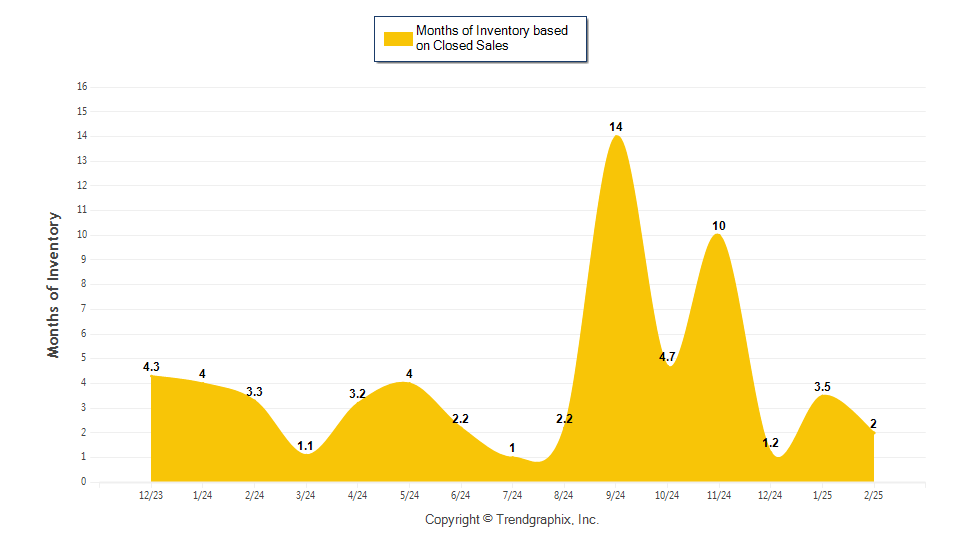

Months of Inventory Based on Closed Sales (Dec. 2023 - Feb. 2025)

|

| Curnt vs. Prev Month | Curnt vs. Same Month 1 Yr Ago | Curnt vs. Same Qtr 1 Yr Ago | | Feb. 25 | Jan. 25 | % Change | Feb. 25 | Feb. 24 | % Change | Dec. 24 to Feb. 25 | Dec. 23 to Feb. 24 | % Change | | Months of Inventory (Closed Sales) | 2 | 3.5 | -42.9%  | 2 | 3.3 | -39.6%  | 1.6 | 3.8 | -57.4%  |

| TODAY’S STATS | | Current vs. Prev MTD | Current vs. Same MTD 1 Yr Ago | Current vs. Prev YTD | | 3/1/25 - 3/13/25 | 2/1/25 - 2/13/25 | % Change | 3/1/25 - 3/13/25 | 3/1/24 - 3/13/24 | % Change | 1/1/25 - 3/13/25 | 1/1/24 - 3/13/24 | % Change | | Months of Inventory (Closed Sales) | 2 | 6 | -66.3%  | 2 | 2.5 | -19.9%  | 2.7 | 2.8 | -3.6%  |

February 2025 was a Seller's market**

Months of Inventory based on Closed Sales in February 2025 was 2. It was down 42.9% compared to last month and down 39.6% compared to last year.

**Buyer's market: more than 6 months of inventory based on closed sales. Seller's market: less than 3 months of inventory based on closed sales. Neutral market: 3 - 6 months of inventory based on closed sales.

|

| Date | 12/23 | 1/24 | 2/24 | 3/24 | 4/24 | 5/24 | 6/24 | 7/24 | 8/24 | 9/24 | 10/24 | 11/24 | 12/24 | 1/25 | 2/25 | | For Sale | 26 | 20 | 23 | 18 | 16 | 16 | 11 | 10 | 13 | 14 | 14 | 10 | 12 | 14 | 10 | | New Listing | 7 | 7 | 13 | 10 | 9 | 7 | 1 | 9 | 7 | 6 | 4 | 5 | 6 | 8 | 10 | | Sold | 6 | 5 | 7 | 17 | 5 | 4 | 5 | 10 | 6 | 1 | 3 | 1 | 10 | 4 | 5 | | Pended | 8 | 11 | 6 | 12 | 6 | 7 | 3 | 6 | 4 | 4 | 4 | 6 | 3 | 6 | 10 | | Months of Inventory (Closed Sales) | 4.3 | 4 | 3.3 | 1.1 | 3.2 | 4 | 2.2 | 1 | 2.2 | 14 | 4.7 | 10 | 1.2 | 3.5 | 2 | | Months of Inventory (Pended Sales) | 3.3 | 1.8 | 3.8 | 1.5 | 2.7 | 2.3 | 3.7 | 1.7 | 3.3 | 3.5 | 3.5 | 1.7 | 4 | 2.3 | 1 | | Absorption Rate (Closed Sales) % | 23.1 | 25 | 30.4 | 94.4 | 31.3 | 25 | 45.5 | 100 | 46.2 | 7.1 | 21.4 | 10 | 83.3 | 28.6 | 50 | | Absorption Rate (Pended Sales) % | 30.8 | 55 | 26.1 | 66.7 | 37.5 | 43.8 | 27.3 | 60 | 30.8 | 28.6 | 28.6 | 60 | 25 | 42.9 | 100 | | Avg. Active Price | 2,367 | 2,295 | 2,134 | 2,053 | 2,322 | 2,309 | 2,589 | 1,896 | 1,899 | 1,710 | 2,242 | 2,695 | 2,996 | 2,961 | 3,189 | | Avg. Sold Price | 1,513 | 2,241 | 1,739 | 1,565 | 1,313 | 2,027 | 1,997 | 1,557 | 2,591 | 2,550 | 1,088 | 1,828 | 1,427 | 1,574 | 2,564 | | Avg. Sq. Ft. Price (Sold) | 507 | 616 | 536 | 518 | 423 | 572 | 601 | 562 | 610 | 758 | 411 | 594 | 495 | 446 | 571 | | Sold/List Diff. % | 92 | 90 | 94 | 92 | 99 | 85 | 92 | 94 | 90 | 91 | 93 | 76 | 88 | 89 | 90 | | Sold/Orig LP Diff. % | 88 | 90 | 87 | 88 | 92 | 83 | 87 | 92 | 84 | 85 | 93 | 76 | 85 | 85 | 86 | | Avg Days on Market | 90 | 41 | 41 | 34 | 68 | 37 | 49 | 35 | 77 | 117 | 16 | 8 | 52 | 103 | 31 | | Median Active Price | 2,145 | 2,145 | 1,499 | 1,450 | 2,265 | 1,595 | 2,799 | 1,624 | 1,300 | 1,399 | 1,749 | 2,395 | 2,495 | 1,947 | 2,050 | | Median Sold Price | 1,268 | 1,700 | 1,625 | 1,370 | 1,300 | 1,853 | 2,150 | 1,275 | 2,777 | 2,550 | 1,165 | 1,828 | 1,327 | 1,203 | 1,500 |

|

|

If your email program is not displaying the chart graphs properly, please click on the following link which will take you to a web page that contains the graphs: Show Chart

*All reports are published March 2025, based on data available at the end of February 2025, except for the today’s stats. This representation is based in whole or in part on data supplied by Realtor Association of The Palm Beaches, Jupiter, Tequesta, Hobe Sound Association of Realtors, and St. Lucie Association of Realtors. Neither the Board nor its MLS guarantees or Neither the Boards nor its MLS guarantees or is in any way responsibles for its accuracy. Data maintained by the Board or its MLSs may not reflect all real estate activity in the market. Report reflects activity by all brokers participated in the MLS.

|

|

|

|